Index holds advantagensin

The VN Index is still considered as a representative of Vietnam's stock market, although it only o represents around 400 stocks on HOSE. However, the influence of this indicator is still very large. The fact that VN Index reached and surpassed the historical peak of 1,420 points, from a technical point of view, it is not difficult to predict as this index holds a remarkable advantage.

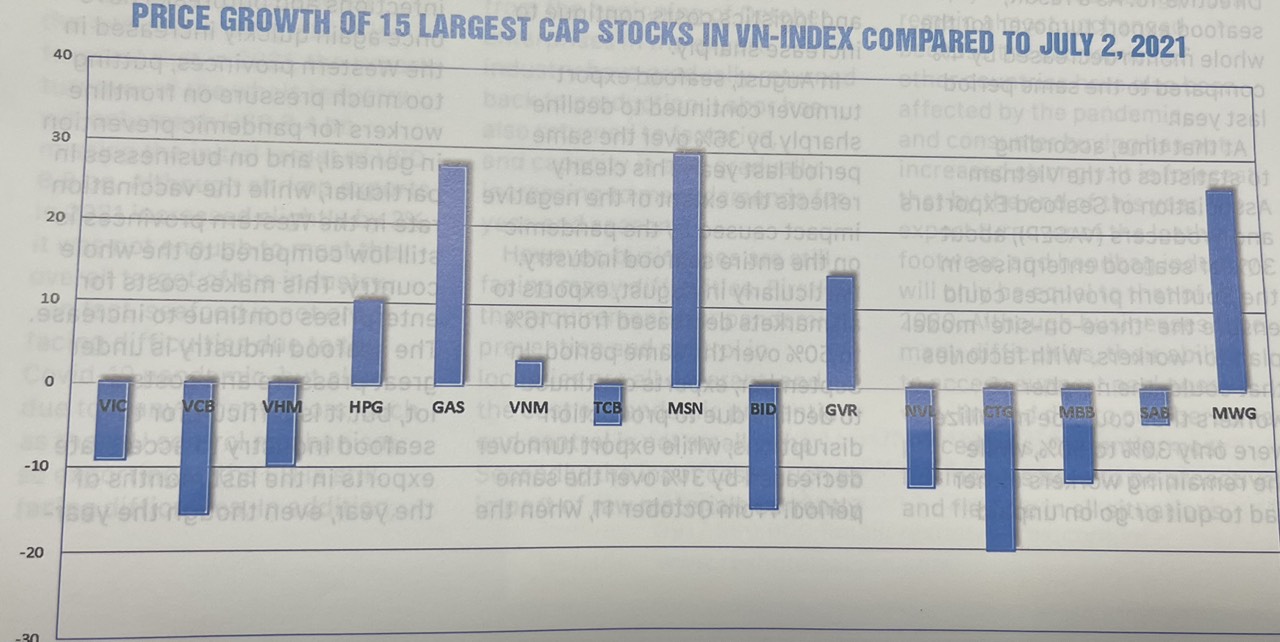

Since this index reached the highest peak of 1,420 points on 2 July 2021 at closing time, the most difficult period lasted for three months until the beginning of October 2021. VN Index ola adjusted down about 5.68%, 30 a decrease that is somewhat disproportionate to many other stocks. For example, VIC fell during this same period by about 16%, VPB down by 13%, ACB down by 14%, VHM down by 13%, MBB down by 16%, STB down by 23%, VCB down by 18%, HDB down by 19%, CTG down by 27%, and BID down by 17%.

It is not difficult to see that 2 the group of bank stocks, which

accounted for a majority of San blue-chips, fell the most during the short-term correction of the market. The VN Index should 21 have corrected much more than minus 5.68% and the chance to recover to a historic peak of 1,420 points, let alone the possibility of surpassing the peak, if there is no alternate lifting supporto from other large-cap stocks. Fora example, HPG in the same period increased by 6.1%, VNM by nearly 2%, MSN by nearly 24%, MWG by 21.1%, TPB by 11.3%, GAS by 7.7%, and GVR by 2,5%.

The increase of these stocks is of course still far from compensating for the decrease in price of large stocks. Of course, that is why VN Index corrected. However, the supporting ability of rising stocks partly limited the loss in the index and this is a prerequisite for VN Index to shorten the recovery time to the old peak and successfully surpass the peak in the past week!

VN Index had gained about 85 points to return to the old peak. Particularly, five stocks, namely, GAS, VIC, HPG, VHM, and GVR

have added about 35 points to the index. Among these five stocks, except for GVR, the remaining on four stocks are in the Top 5 0g largest capitalization stocks of VN Index. The other ticker was VCB, which led the whole group of banking stocks to increase in two decisive sessions on 27 and 28 October, officially bringing the index over the top completely.

In other words, from helping VN Index successfully for three months, blue-chips have supported the index at the right time. That is when big companies start to publish their third quarterly financial statements. Although the effect on the uptrend on business results is not clear, timing is important for VN Index. Bank stocks, for example, although rising at the right time to support the index surpassing the top, most of the prices are still in the downtrend or only accumulating sideways.

Divergent picture

Although the VN Index has surpassed the historical peak, this is only symbolic. The stocks

that make up this index have had an extremely harsh divergence, in which many stocks brought high profits, but also many stocks collapsed the whole investment portfolio. So the timing factor is important for the index, but not for investment performance.

The HoSE alone has about 200 stocks that do not care if VN Index surpasses the historical peak in early July or not, because compared to the prices of these same codes at the same time as the index peaked, the price has increased by tens of percent, with even 12 stocks doubling. On the contrary, even though the VN Index surpassed the historical peak, there were also hundreds of stocks whose prices were still flat and far below the equivalent price at the time of the VN Index reaching 1,420 points. In other words, VN Index surpassing the peak does not guarantee a commensurate investment return.

It is not only individual investors who fall into a difficult situation for their portfolios if only based on the VN Index. Many large investment funds also had

to announce a drop in investment performance due to the market divergence. Taking into account the consistency of the belief that the index has surpassed the peak, there is no organization as steadfast as PYN Elite Fund, an investment fund from Finland.

Since the end of 2020, the representative of this fund has affirmed that the VN Index will eventually reach 1,800 points. By the beginning of 2021, this fund confirmed that the index would reach 1,500 points at the end of the year when no one believed it. Until August, when the market plunged, the fund's representative still persisted in the VN Index target of 1,500 points. Now, with only two months left to end the year, VN Index has surpassed 1,420 points and the distance to 1,500 points is closer than ever. However, the investment performance of this fund is still affected in the short term when July 2021 decreased by 5.5%, August decreased by 0.19% and recovered only 2.1% in September.

The divergence of stocks in the current period is not much affected by Q3 business

results, but is mainly driven by future growth expectations. This answers why many stocks reported losses in the third quarter or decreased growth but are still popular with investors. For example, real estate, construction, and retail stocks are heavily affected by social distancing, but opportunities will return after economic activities are normalized. Meanwhile, many bank stocks have good profits but the increased risk of bad debt becomes less attractive.

According to VNDirect Securities combined profit for the third quarter of 2021 until 26 October, the total profit of companies that have announced results increased by 25.0% over the same period for the third quarter of 2021 and 46.7% compared to the same period last year, and same period for the first nine months of the year. The stocks in VN30 had a growth rate of 22.2%. However, most of the stocks of the VN30 basket did not grow commensurately, even though these are the stocks that brought the VN Index to a new history high.

Nguyen Ha

Điện thoại: 0909.140.866

Email: info@irrmanagement.com.vn